Hampton Roads Retail Pulse Survey 2024 Holiday Season Outlook

POSITIVE START TO THE HOLIDAY SEASON FOR RETAILERS NATIONALLY

Retail Alliance is excited to share that the Thanksgiving holiday shopping weekend exceeded expectations nationwide, marking a positive start to the season. According to the National Retail Federation (NRF), more than 197 million consumers shopped from Thanksgiving Day through Cyber Monday, surpassing forecasts by nearly 14 million shoppers. This strong turnout highlights the resilience and adaptability of retailers as they kicked off the critical holiday shopping period.

The NRF projects holiday spending will increase by 2.5% to 3.5% compared to 2023, with the season spanning from November 1 to December 31. As of December 1, data reveals that consumers still have more than half of their holiday shopping left, suggesting ample opportunities for retailers to capitalize on the remaining weeks.

Over the Thanksgiving weekend alone, consumer spending averaged $235 per shopper, reflecting an $8 increase over last year, with popular purchases including apparel, accessories, toys, and personal care items.

Black Friday led the way as the most popular shopping day, attracting 81.7 million in-store shoppers and 87.3 million online. Cyber Monday followed as the second most prominent day for online shopping, with 64.4 million consumers participating.

Notably, a record 126 million people shopped in person during the five-day period, underscoring a continued desire for holiday experiences and social interactions.

Despite a shorter shopping window of only 26 days between Thanksgiving and Christmas, retailers have effectively countered these challenges with compelling deals and promotions.

The NRF anticipates holiday sales to grow at a slower pace this year, but the robust start to the season suggests retailers are well-positioned to navigate these headwinds and drive consumer engagement.

HAMPTON ROADS RETAIL PULSE SURVEY 2024 HOLIDAY SEASON OUTLOOK: KEY INSIGHTS

The 2024 Retail Pulse Survey, conducted with retailers, restaurants, and retail services across Hampton Roads, offers a comprehensive view of the business landscape as the holiday season approaches. The findings provide valuable insights into industry trends, sales expectations, online retail growth, marketing strategies, business challenges, and staffing concerns.

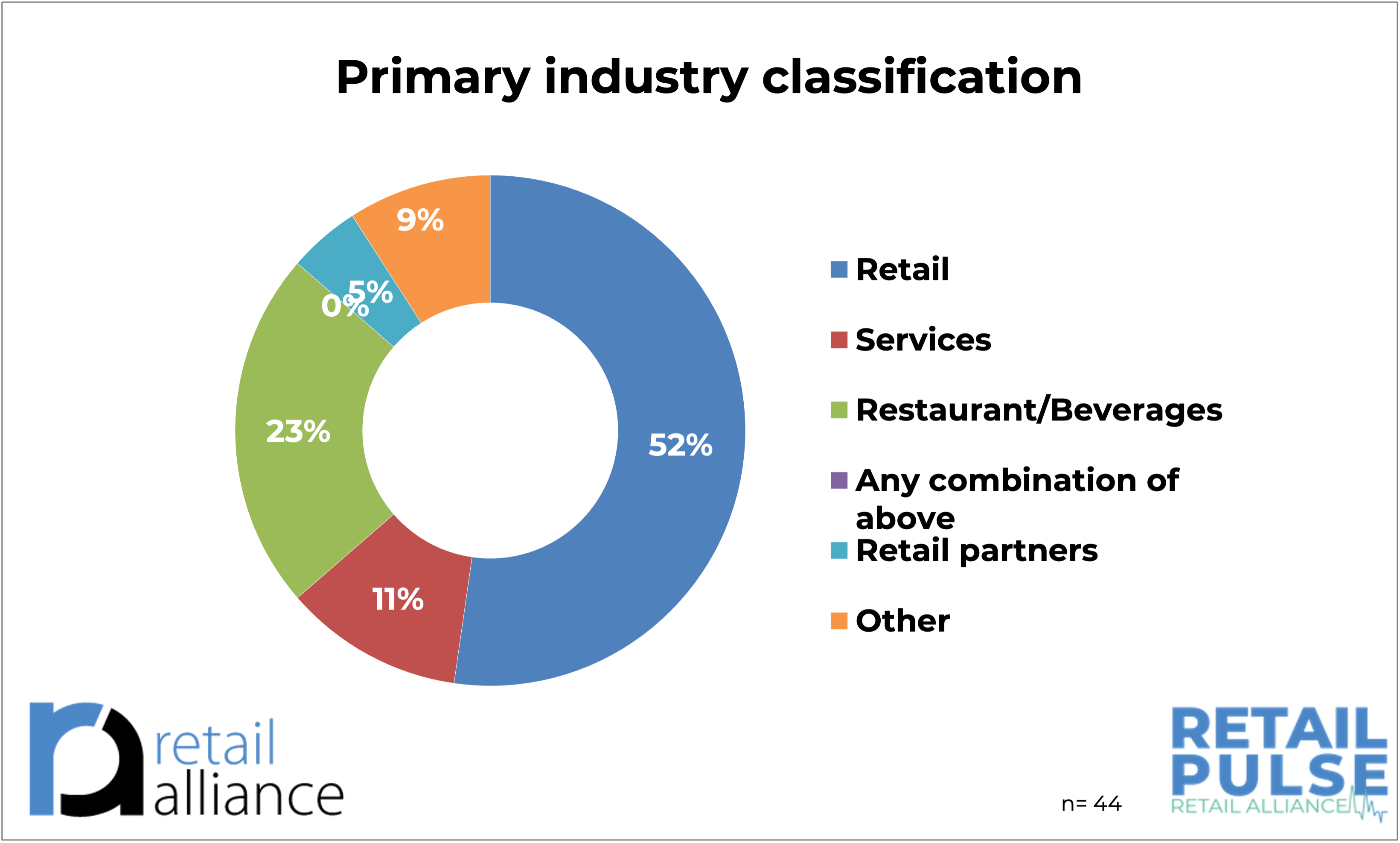

Industry Representation

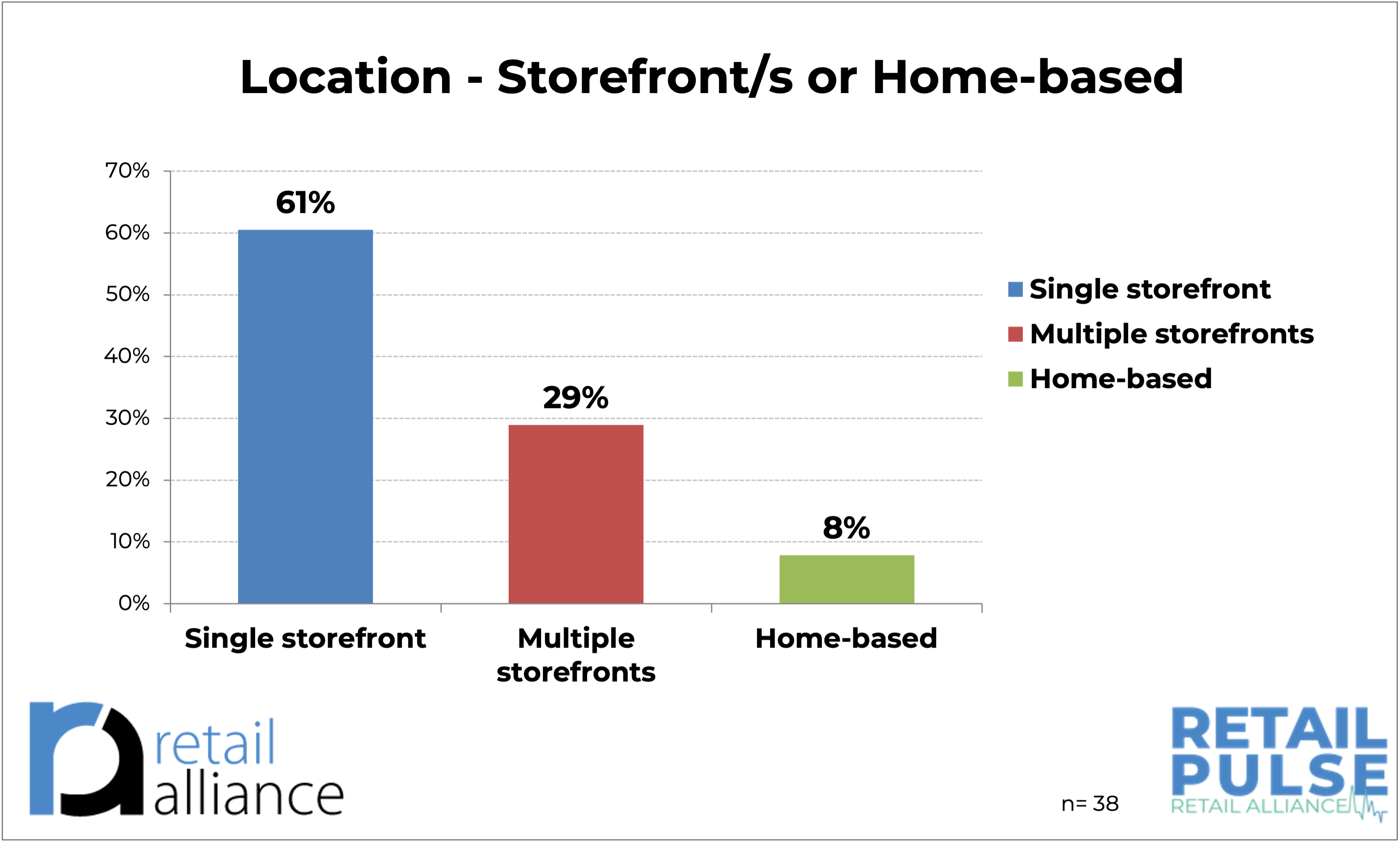

Respondents represented traditional retail storefronts, home-based retailers, dining establishments, and service-oriented businesses. This diversity highlights the broader economic ecosystem that contributes to the holiday shopping season.

Retailers made up the majority of respondents, followed by a significant portion of restaurants and service providers, reflecting Hampton Roads' rich mix of consumer-facing enterprises.

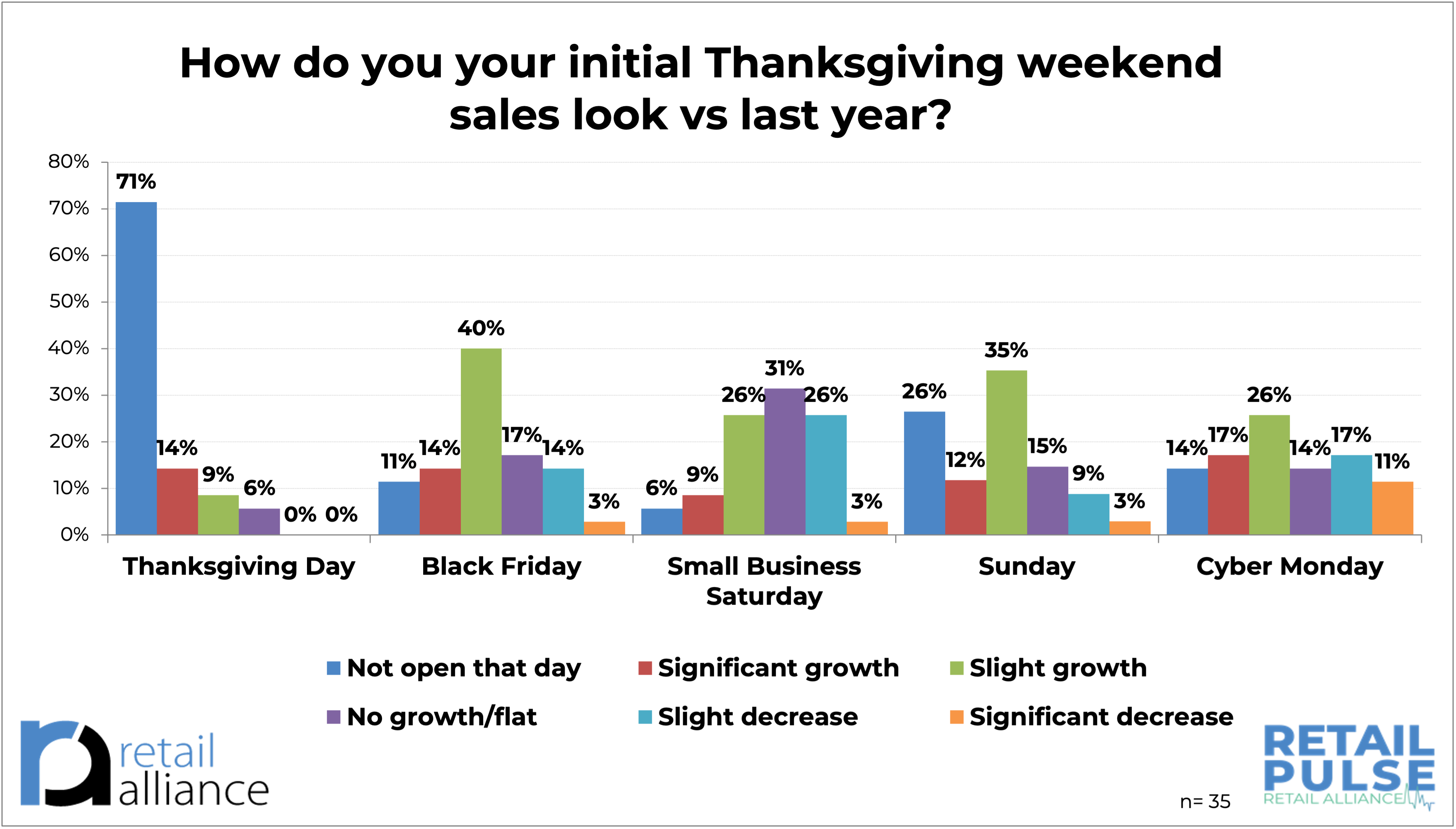

Thanksgiving Weekend Sales Analysis

- Thanksgiving Day:

- 71% of businesses were not open on Thanksgiving Day.

- For those that were open:

- 9% experienced slight growth.

- 6% reported no growth/flat sales.

- 14% saw significant growth.

This indicates that Thanksgiving Day remains a less active shopping day for small retailers, with most businesses choosing to remain closed.

- Black Friday:

- 40% reported slight growth in sales, making it the most optimistic day for slight sales increases.

- 14% reported significant growth,

- 14% experienced a slight decrease, while 17% had no growth.

- Only 3% experienced a significant decrease in sales.

Black Friday remains a strong sales driver, with a notable percentage of businesses experiencing positive trends.

- Small Business Saturday:

- 31% experienced no growth, which is the highest among all days analyzed.

- 26% reported slight growth, and an equal percentage saw slight decreases.

- 9% saw significant growth.

Small Business Saturday showed mixed results, with many businesses reporting flat sales or slight decreases.

- Sunday:

- 35% saw slight growth, and 12% experienced significant growth.

- 15% reported no growth, while 9% experienced a slight decrease in sales.

- Significant decreases were less common at 3%.

Sunday is a relatively positive day with similar sales growth compared to Small Business Saturday.

- Cyber Monday:

- Results were distributed evenly:

- 26% experienced slight growth, while 17% saw significant growth

- or slight decreases.

- 14% reported no growth, while 17% and 11% experienced slight and significant decreases respectively.

Cyber Monday demonstrates a balance between growth and challenges, likely tied to its focus on online sales.

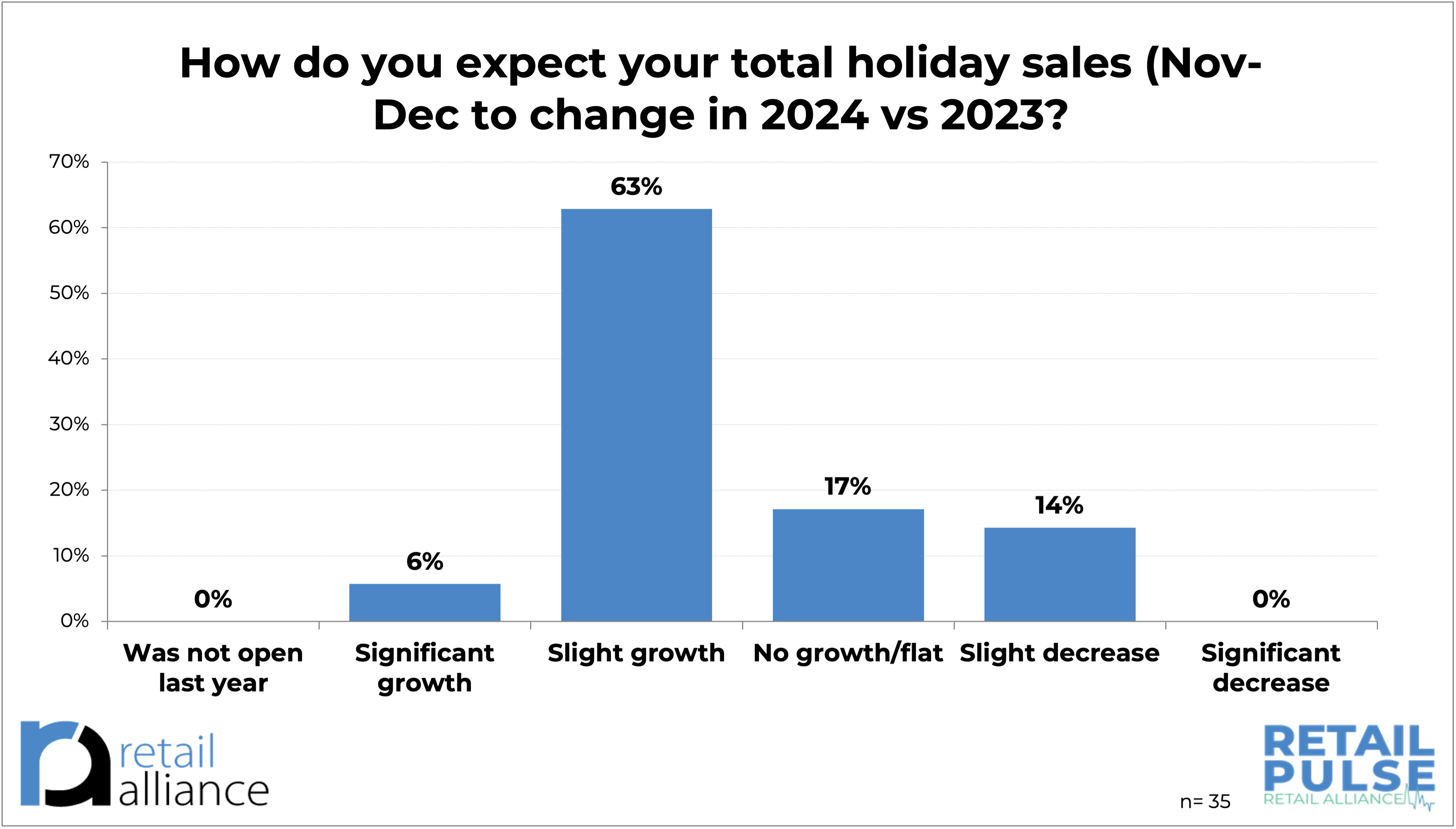

Holiday Sales Expectations

Retailers are cautiously optimistic about the upcoming season with expectations for 2024 remaining mixed. Approximately 70% of respondents anticipate holiday sales to increase compared to last year. However, about 30% expressed concerns about flat sales or potential declines.

Online Retail Trends

Online sales continue to play a critical role in the retail landscape with retailers who sell products and services online reporting the following:

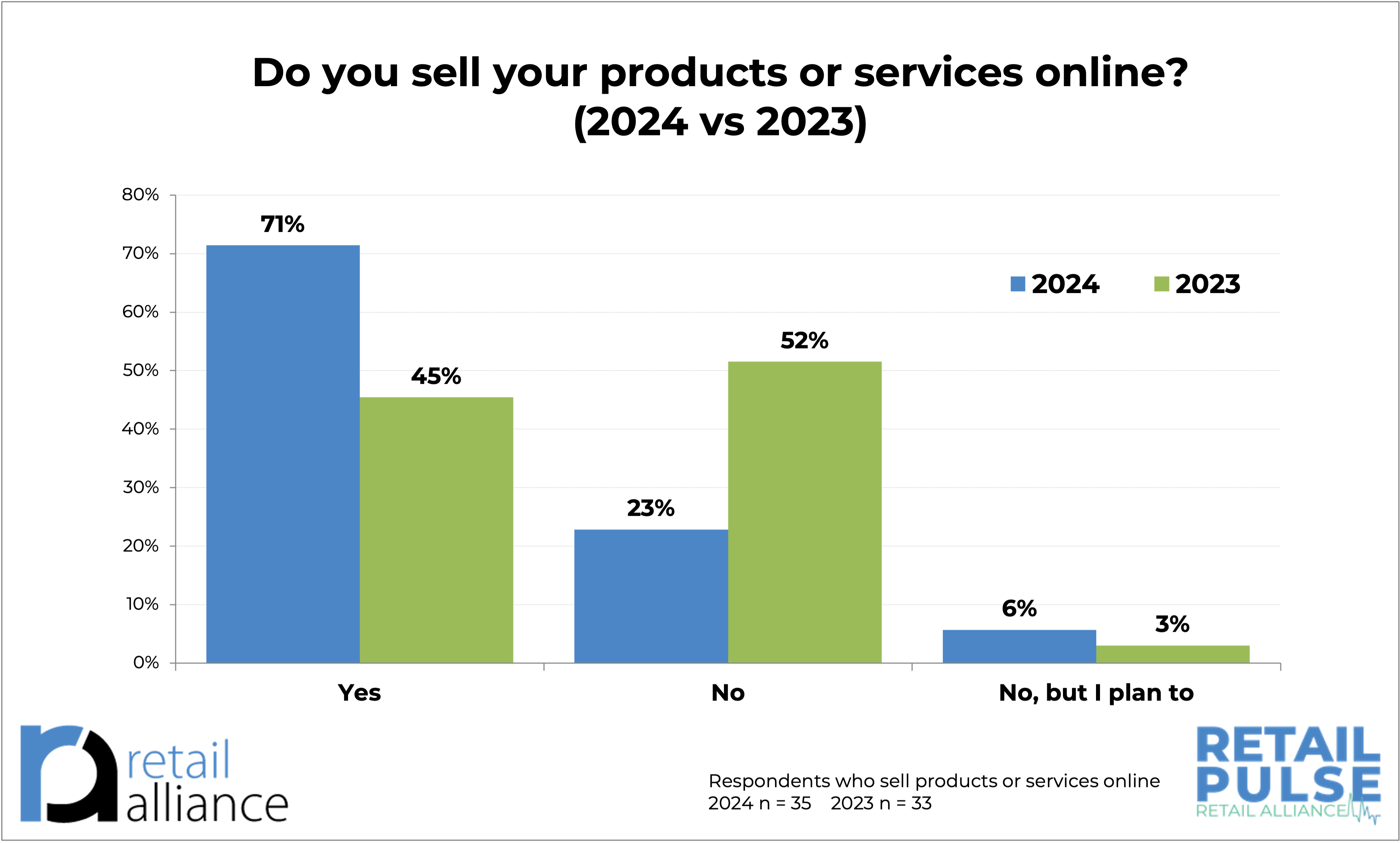

- 71% of respondents indicated that they sell online in 2024 versus 45% in 2023, underscoring the importance of e-commerce in holiday planning and the growth of e-commerce by small retailers.

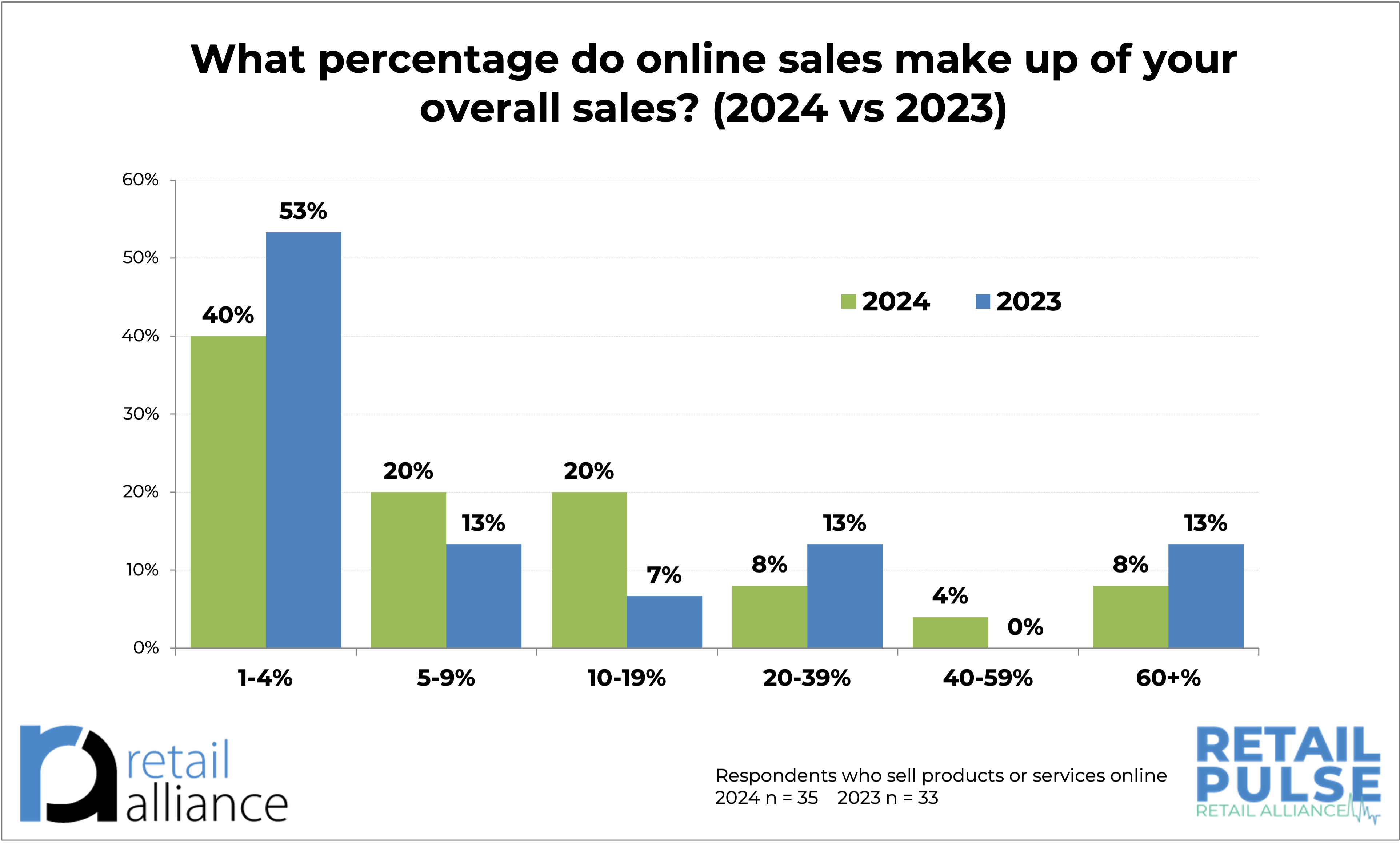

- For businesses with an online presence, online sales accounted for an average of 20% or less for the majority of retailers:

- 40% report 1-4% in online sales in 2024 versus 53% in 2023

- 20% report 5-9% in online sales in 2024 versus 13% in 2023

- 20% report 10-19% in online sales in 2024 versus 7% in 2023

- 8% report 20-39% in online sales in 2024 versus 13% in 2023

- 4% report 40-59% in online sales in 2024 versus 0% in 2023

- 8% report 60+% in online sales in 2024 versus 13% in 2023.

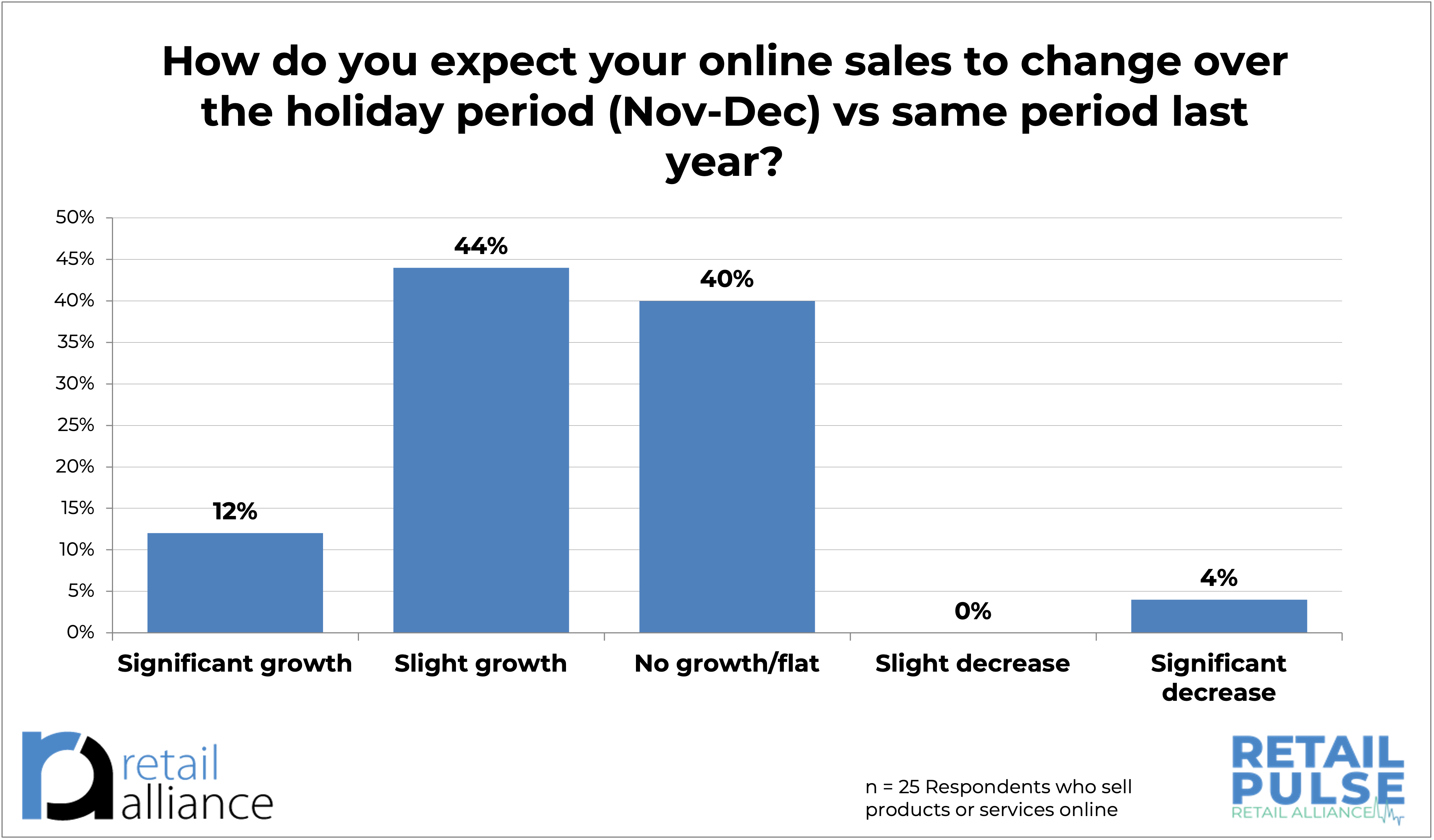

- 56% expect their online sales to grow compared to 2023.

Marketing Strategies

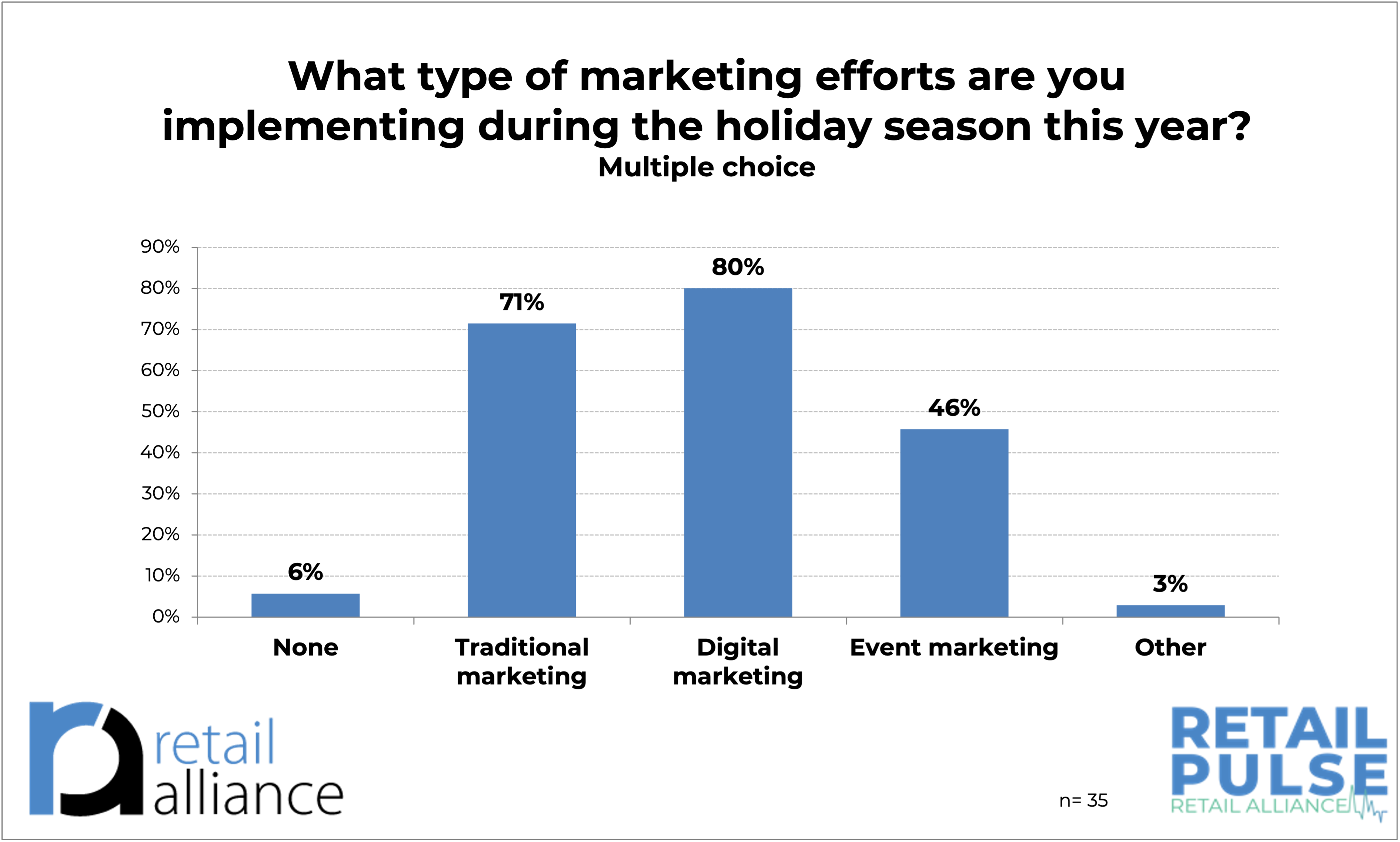

Effective marketing remains a cornerstone of holiday success. Respondents reported using a mix of traditional and digital approaches:

- Digital marketing such as content marketing, email marketing, mobile marketing, pay-per-click, etc. were the most utilized, with 80% of businesses leveraging them for marketing.

- Traditional marketing such as television advertising, direct mail, word of mouth, public relations, etc. followed closely (71%), reflecting a desire to create both digital and physical touchpoints with customers.

- Nearly 50% are using event marketing such as experiential events like pop-ups and workshops, interactive marketing such as playing a game to win a giveaway.

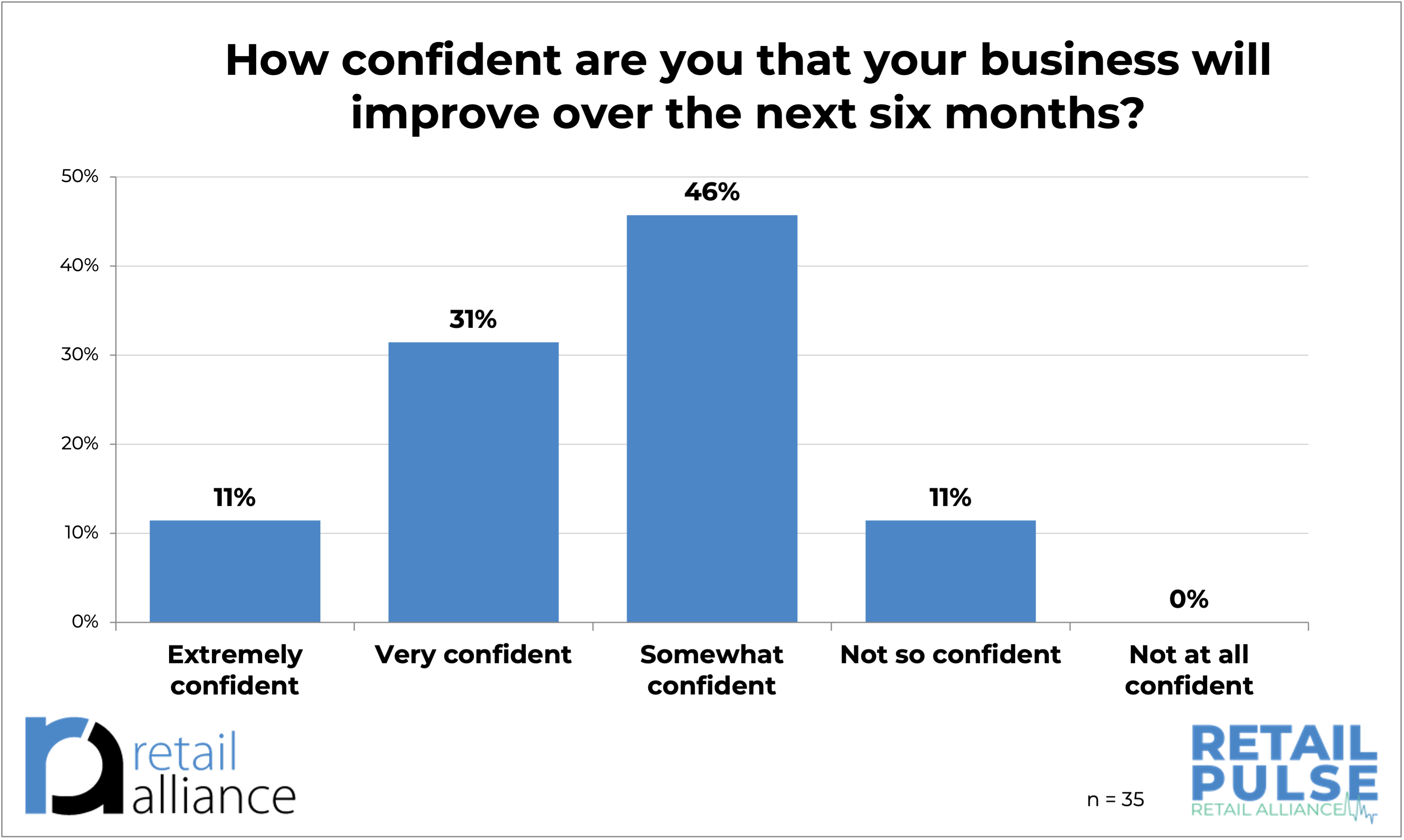

Business Confidence and Challenges

Business confidence over the next six months is extremely optimistic, with 88% of respondents expressing moderate to high confidence in their operations.

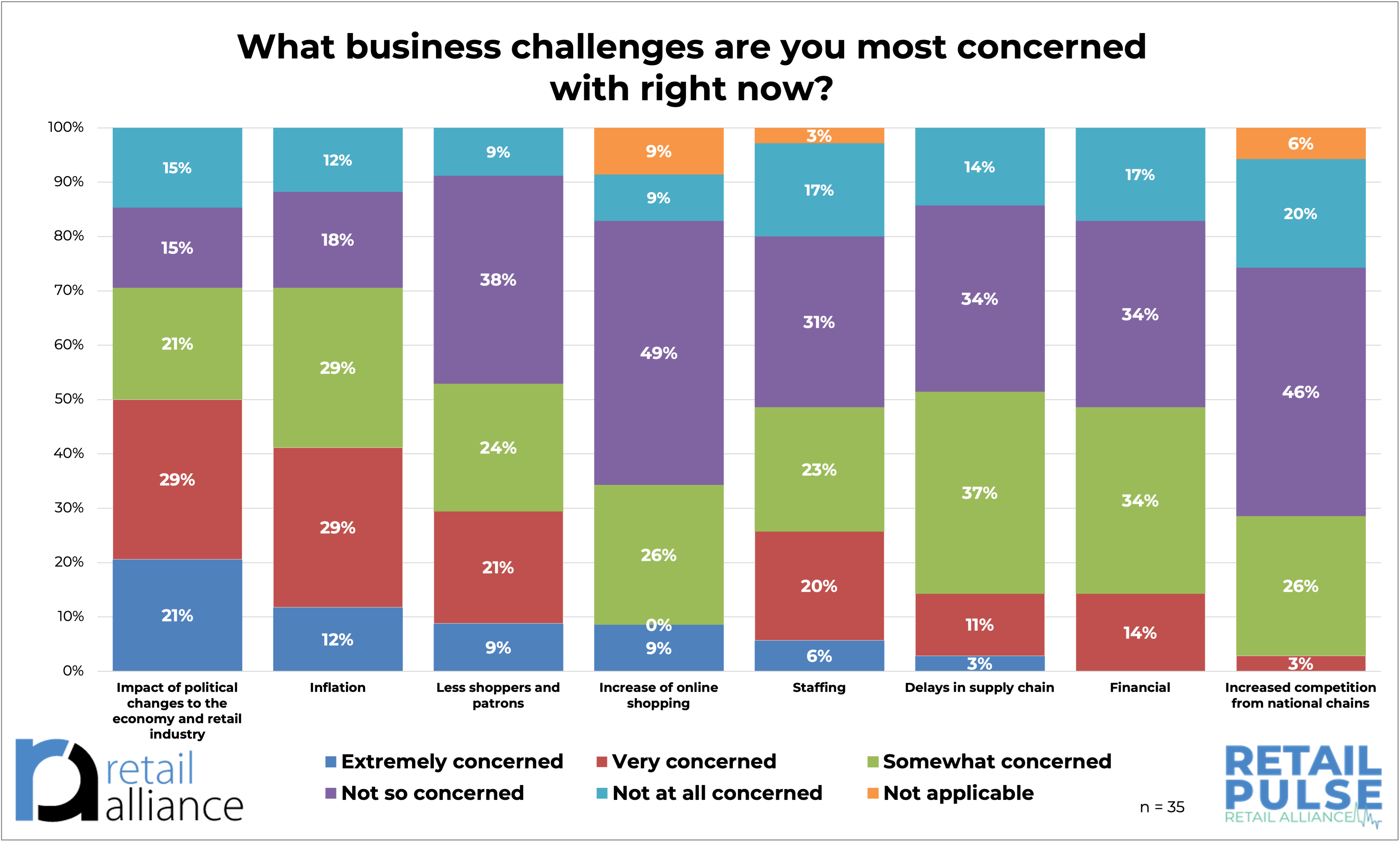

However, challenges persist. Small retailers are facing a range of challenges, with inflation, political changes, and staffing emerging as their top concerns. A significant portion of businesses expressed high levels of concern about inflation (29% very concerned) and the impact of political changes on the economy (29% very concerned, 21% extremely concerned).

Staffing challenges also remain a persistent issue, with 43% of respondents either very or somewhat concerned. Financial strain and delays in the supply chain are moderate concerns, affecting a notable percentage of businesses, though not as critical as inflation or staffing.

Conversely, fewer businesses are troubled by increased online shopping or competition from national chains, with many reporting these issues as not applicable or only minor concerns. This suggests retailers are adapting to the evolving landscape or are less directly impacted by these factors.

Overall, while economic pressures dominate the retail landscape, businesses are actively navigating these challenges with varying levels of success.

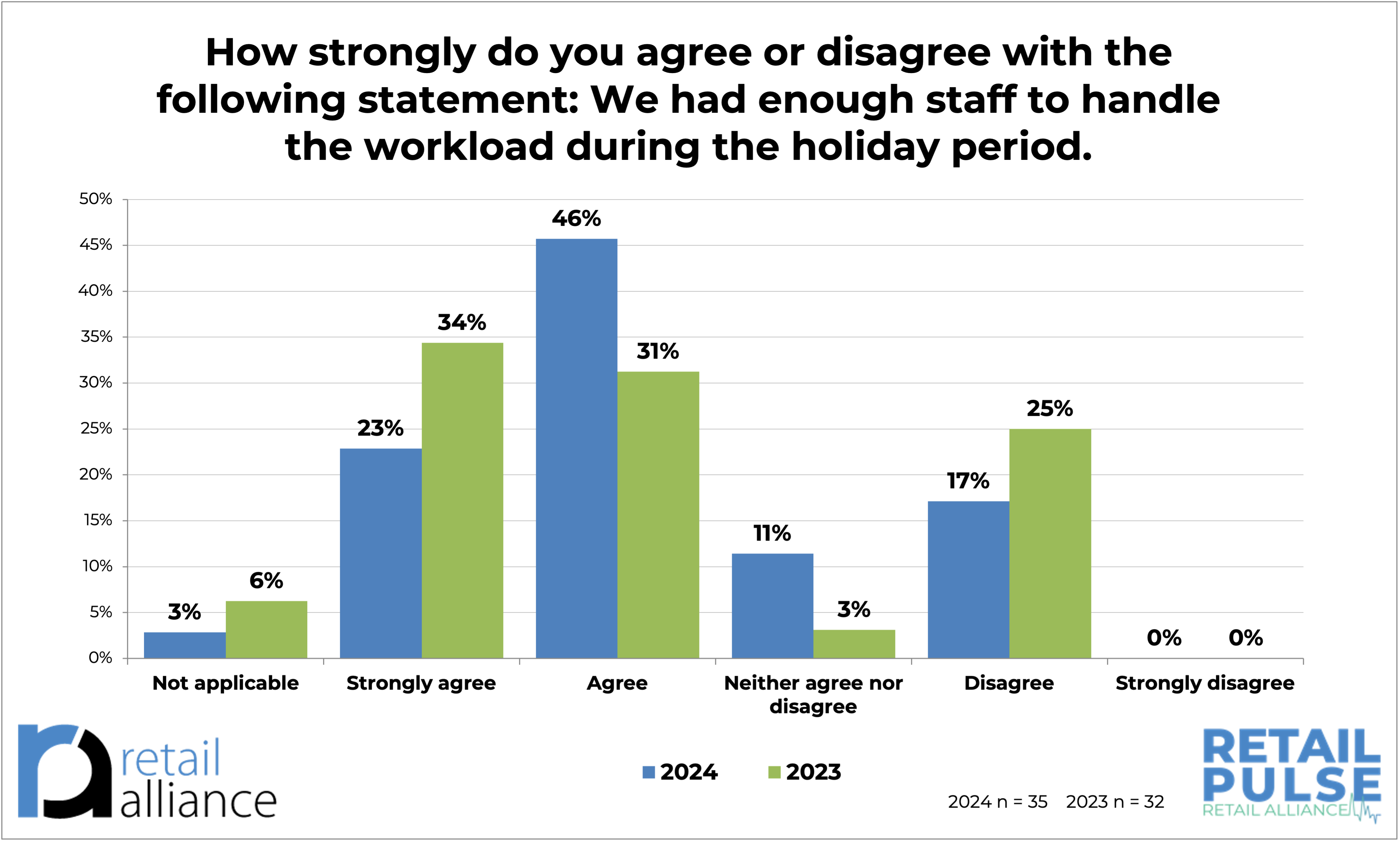

Staffing

Staffing remains a critical issue:

- 17% of businesses reported difficulties in hiring seasonal workers, potentially impacting their ability to meet customer demand during peak times. This is an improvement from last year where 25% of businesses felt they didn’t have enough staff during the holiday period.

Conclusion

The 2024 holiday season presents both opportunities and challenges for Hampton Roads businesses. While optimism abounds in areas such as online sales growth and innovative marketing, economic uncertainties and staffing shortages continue to test resilience. This survey underscores the importance of adaptability and community collaboration as businesses navigate the season. Retailers in Hampton Roads remain committed to delivering exceptional experiences to their customers, ensuring a vibrant and prosperous holiday season for all.

About Retail Alliance

At Retail Alliance, we unite with retailpreneurs for a thriving retail community through professional development, collaboration, innovation, a collective voice, and shared values, shaping the future of retail together. Retail Alliance champions for the retail industry and serves as the primary non-profit retail trade association in Hampton Roads.