Retail Pulse Results of Pre-Holiday Survey 2023

Positive Start to the Holiday Season for Consumers and Retailers

The season is off to a solid start with an increase in core retail sales* nationally of 0.73 percent month over month and 4.17 percent year over year in November according to CNBC/NRF Retail Monitor, powered by Affinity Solutions, using actual credit and debit card purchase data.

National Retail Federation predicts U.S. holiday retail sales* (Nov 1 – Dec 31 2023) to grow 3-4 percent over 2022, equating to a record total of between $957.3 billion and $966.6 billion.

*excludes auto, gas, restaurants

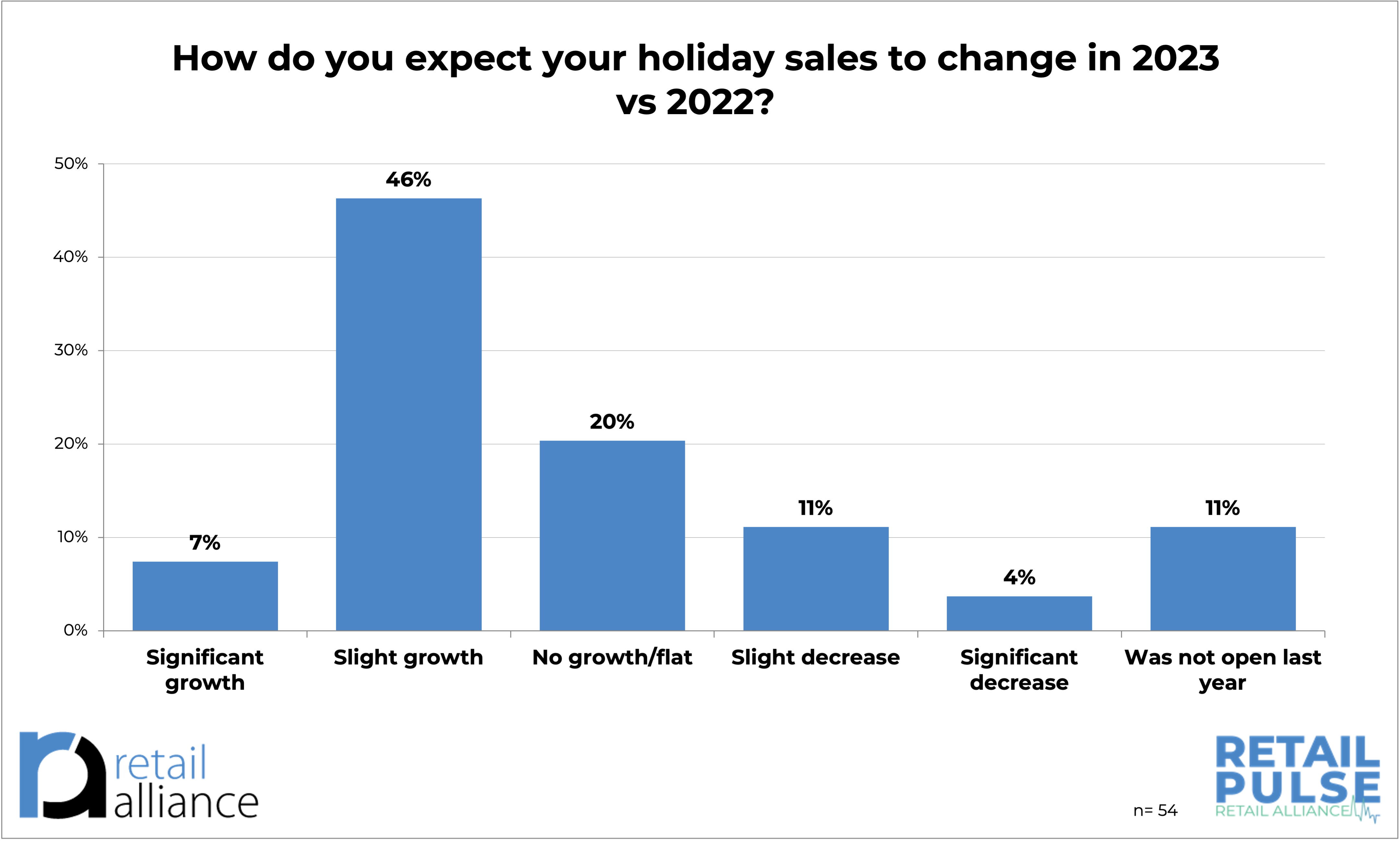

Slight sales growth expected by Hampton Roads’ retailers during holidays

This is mirrored on a local level with retailers expecting a slight growth in sales this holiday season according to Retail Alliance’s Retail Pulse survey of 54 Hampton Roads’ retailers.

The survey of local retailers in Hampton Roads was conducted between November 15 and December 8, 2023 and received 57 responses. One in five (20.0%) expected no growth this holiday season. Eleven percent (11.0%) expected a slight decrease and four percent expected a significant decrease.

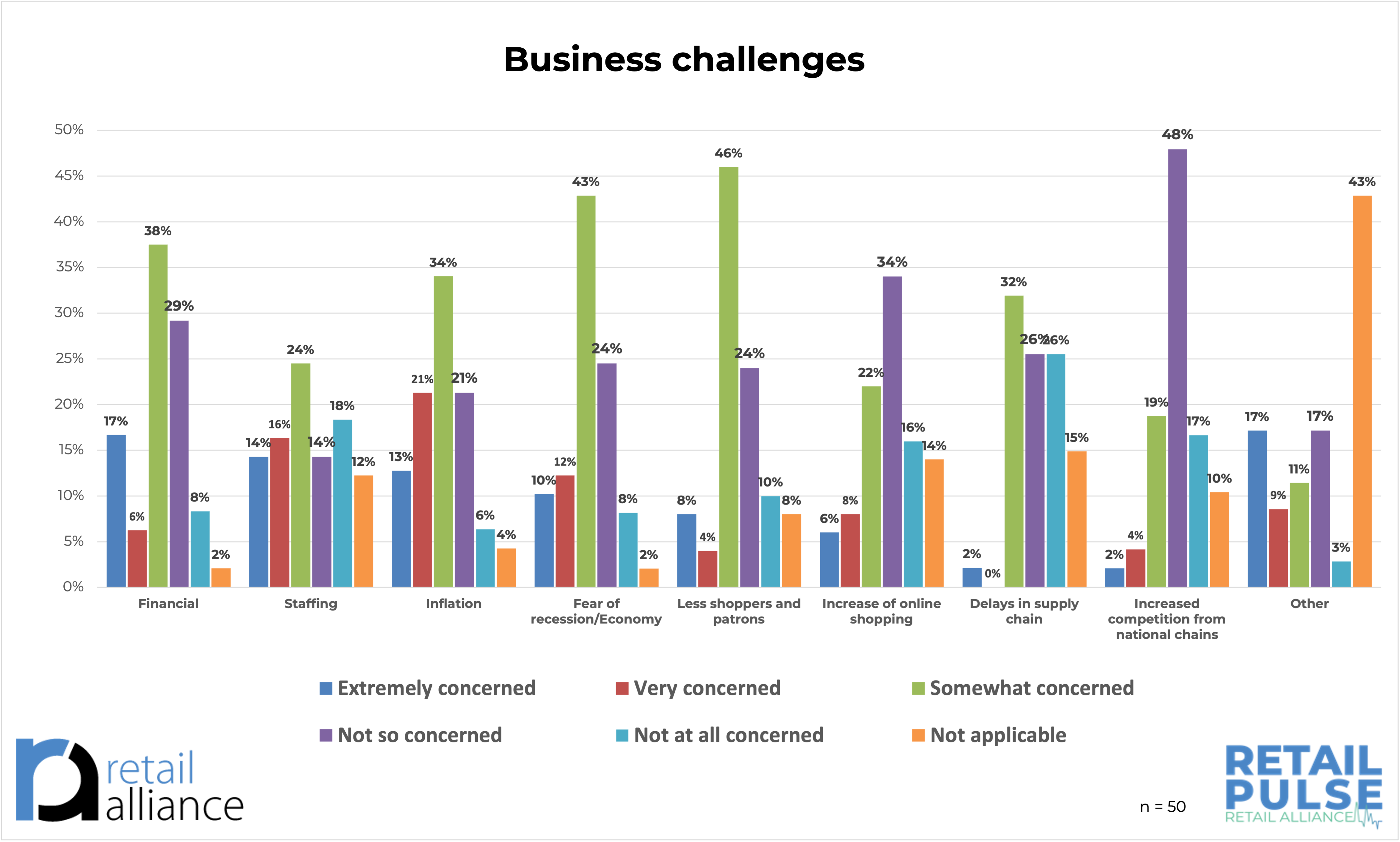

Challenges continue for local retailers this holiday season

Many challenges retailers are facing this holiday are a continuation from previous years such as Inflation, Economy, Staffing, and Financial concerns.

Financial concerns were of extreme concern to 17 percent (17%) of retailers, followed by Staffing (14%), and Inflation (13%).

Overall, inflation was of the highest concern overall (68% of all concerned = Extremely Concerned, Very Concerned, Somewhat Concerned) followed by Fear of Recession/Economy (65% of all concerned).

Interestingly, small local retailers were not as concerned (48%) about big box competition with only 19 percent (19%) somewhat concerned, four percent (4%) very concerned and two percent (2%) extremely concerned.

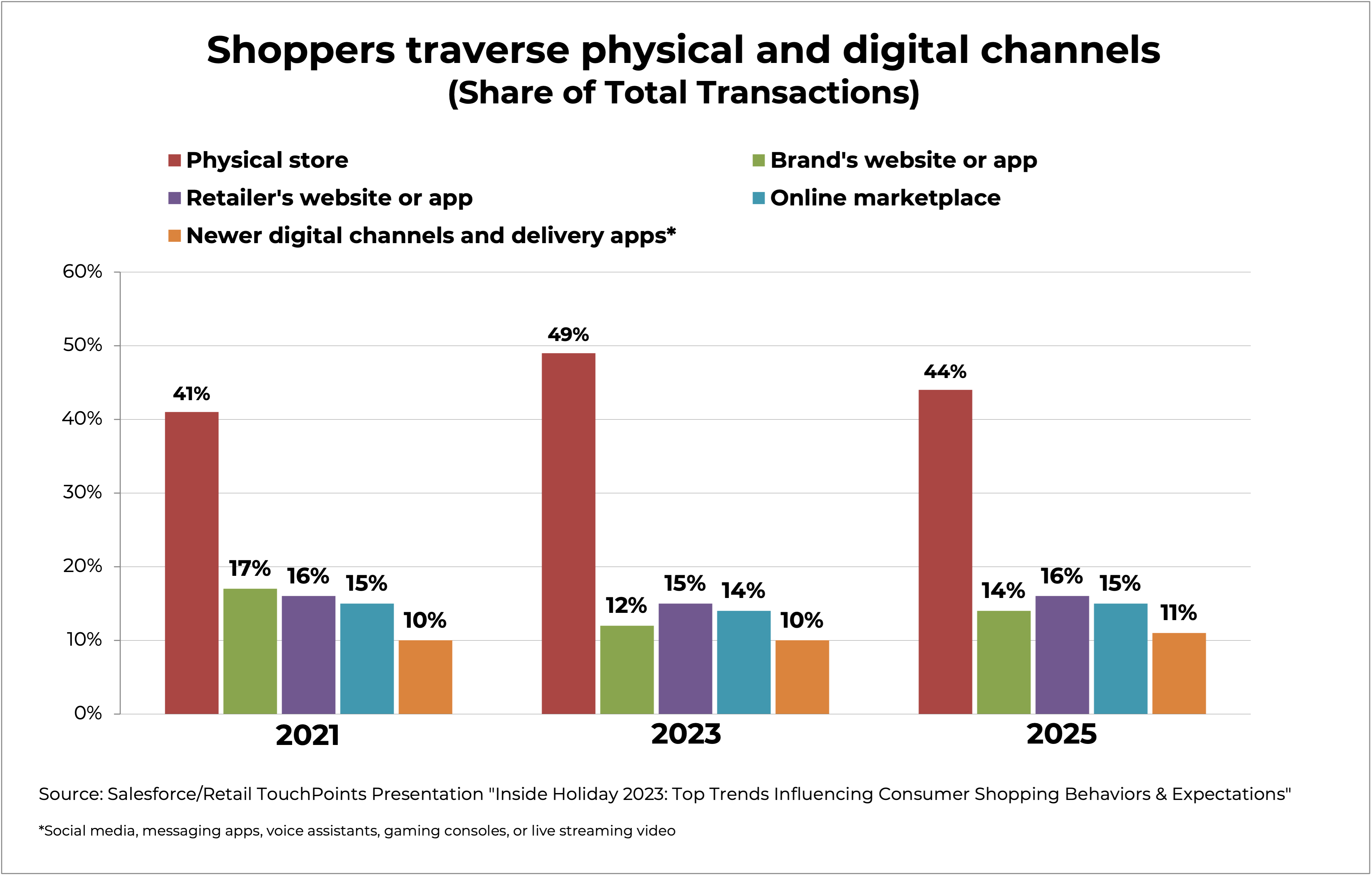

Shoppers blending physical and digital shopping

The national trend in digital shopping shows a slowing of growth according to Retail TouchPoints and Salesforce presentation on “Inside Holiday 2023: Top Trends Influencing Consumer Shopping Behaviors & Expectations”.

According to the findings, US shoppers are pulling back their purchases online with discounting driving demand. Growth is forecast to be moderate during November and December with only one percent (1%) year over year growth predicted, totaling $273B in sales.

Consumers shopping habits are remaining unchanged over the past few years the presentation reported, with physical stores continuing to capture the largest portion of spending. The forecast until 2025 expects little change.

This bodes well for many of our local retailers who rely on in-store shopping for the majority of their sales.

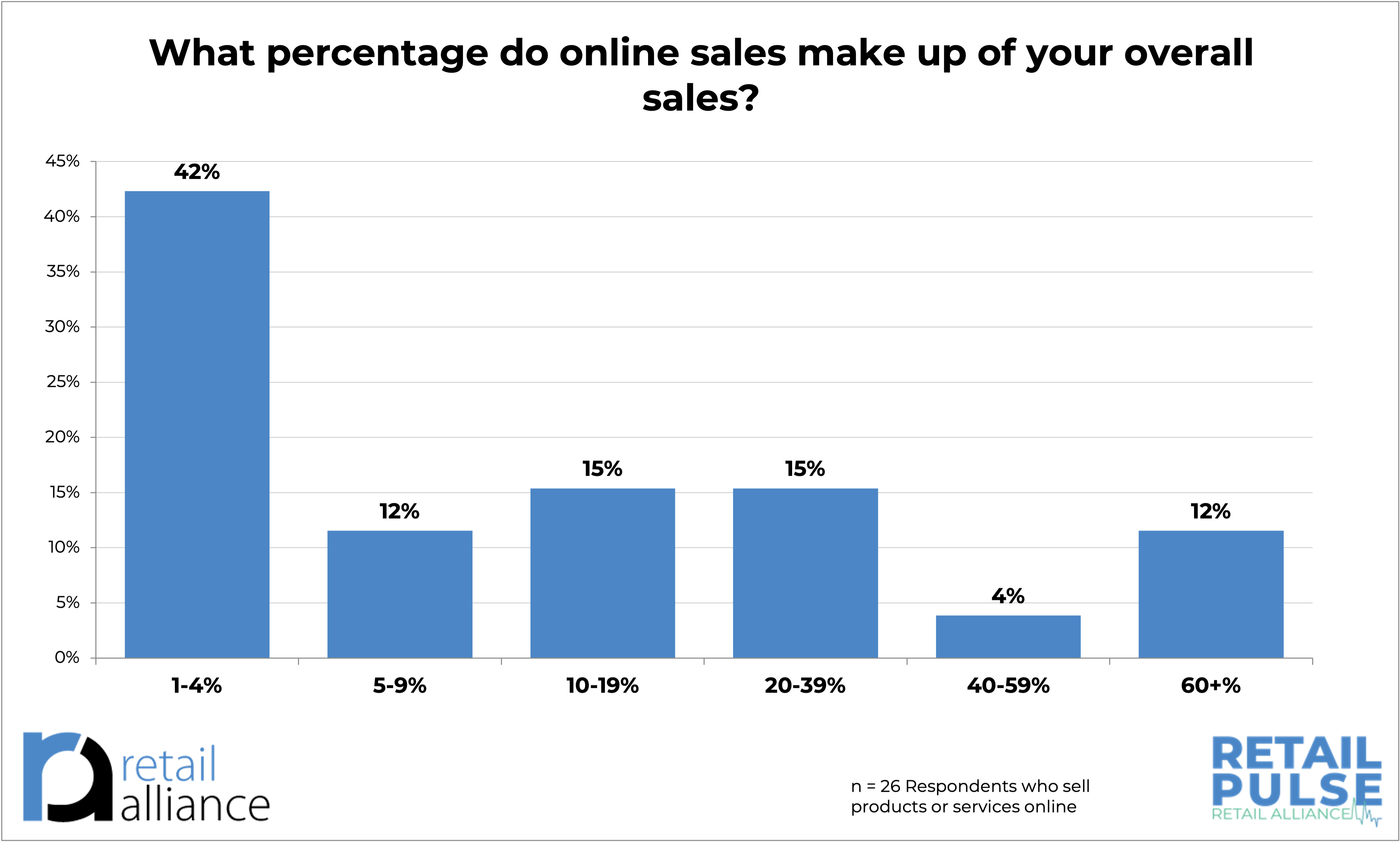

Although e-commerce is popular at a local level, online still not a large portion of retail sales

Nearly half of respondents (48%) claimed to sell their products online with another eleven percent (11%) planning on doing so in the future.

With e-commerce and social selling becoming increasingly popular, it may take some years to drive strong sales on this sales platform at a local level.

Of those that have incorporated selling online into their business model, over two in five (42%) report that online sales make up between one and four percent (1-4%) of their overall sales. On the other end of the scale, 12 percent (12%) state that online sales make up more than 60 percent (60%) of their total sales.

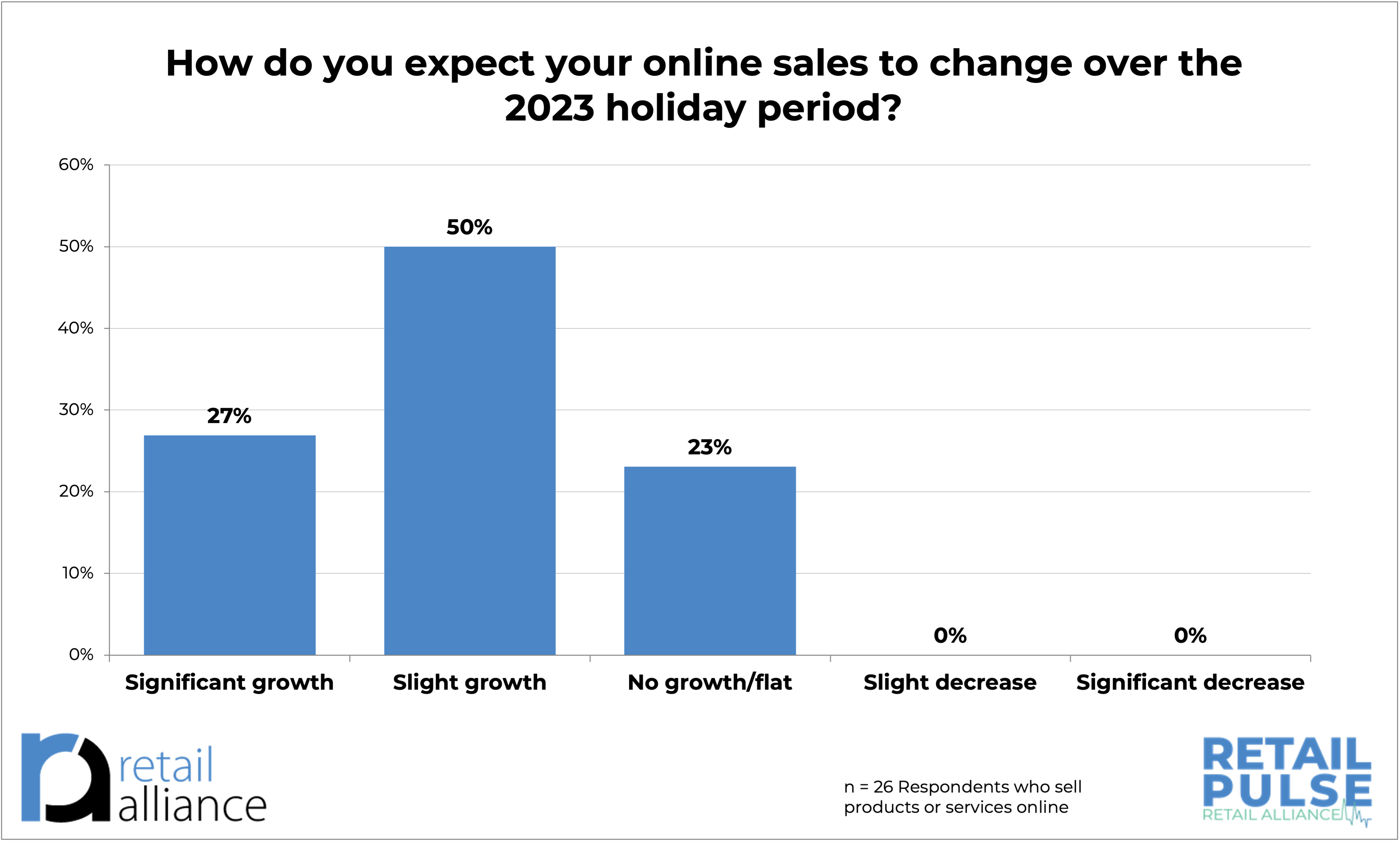

The forecast is positive for many local retailers, with over three quarters (77%) expecting online sales to show a slight to significant growth over the holidays. Twenty three percent (23%) are not so positive, predicting flat or no growth in online sales over the holidays.

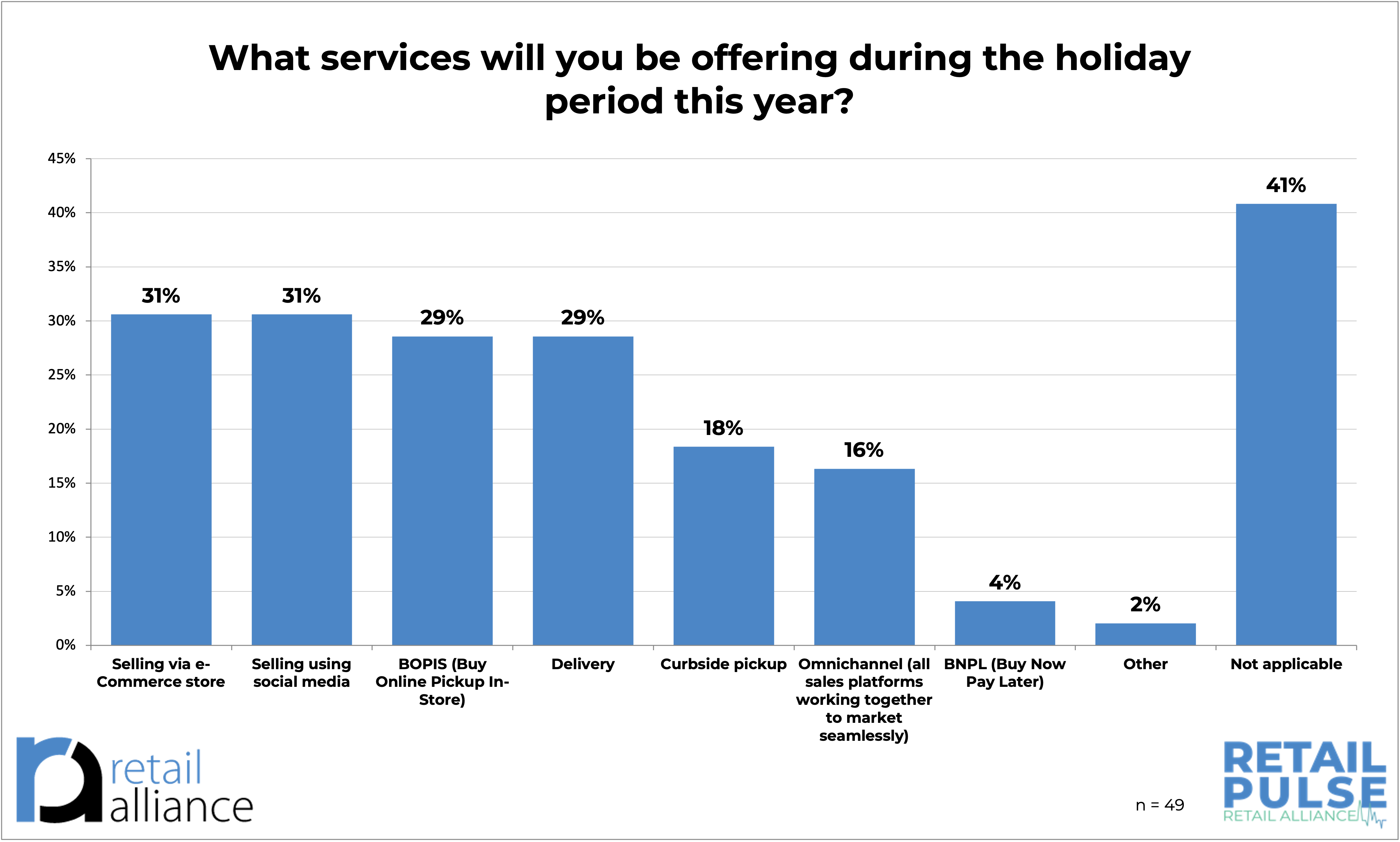

A mix of sales platforms and services used by retailers this holiday season

E-commerce offerings are popular with 31 percent of retailers surveyed, followed by social selling (31%), BOPIS (Buy online pickup in store) (29%), and offering delivery services (29%).

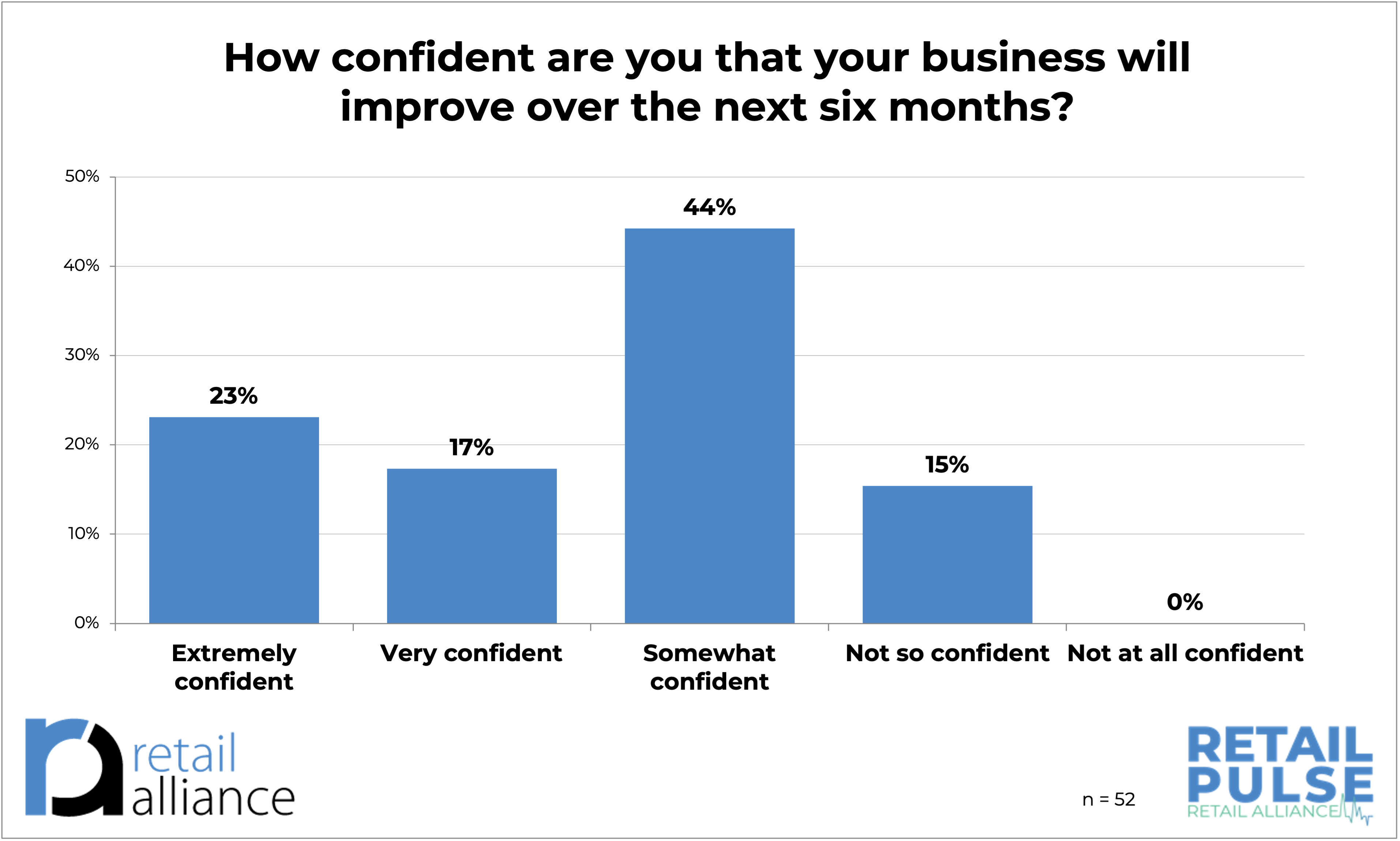

Confidence remains high despite economic, financial and staffing concerns

Most small business owners who responded to our pre-holiday survey have some level of confidence that their business will improve over the next six months (84%). Fifteen percent (15%) aren’t so confident but the good news is that no one (0%) had a complete lack of confidence that their business would improve over the next six months.

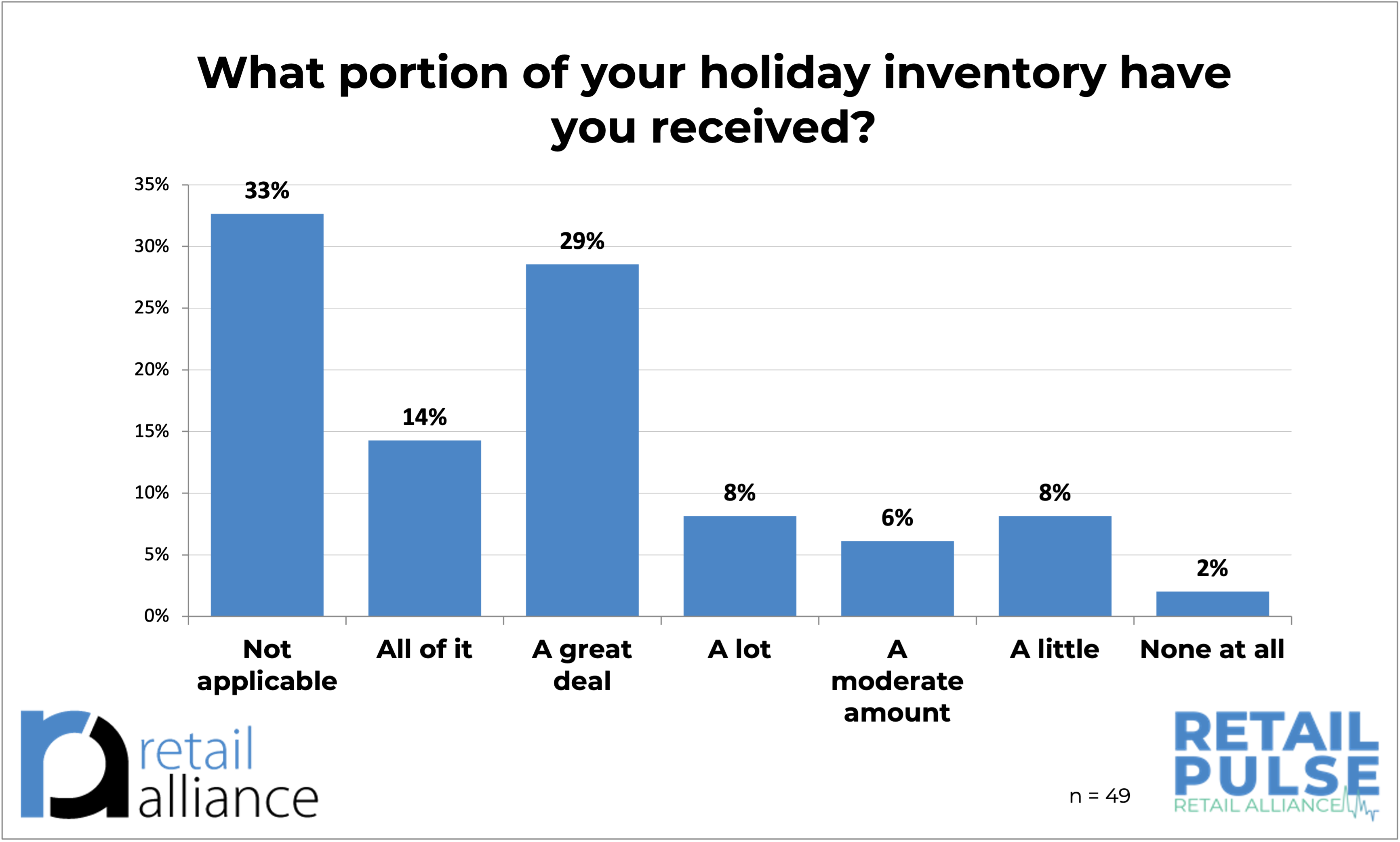

Majority of retailers have received holiday inventory

With supply chain issues fresh in their minds from previous holiday seasons, many retailers had ordered and received the majority of their inventory prior to the survey period. Fourteen percent (14%) of retailers reported having received ALL of their holiday inventory, with the majority having received at least a portion of it already. Only two percent (2%) had not received any of their inventory at the time of the survey.

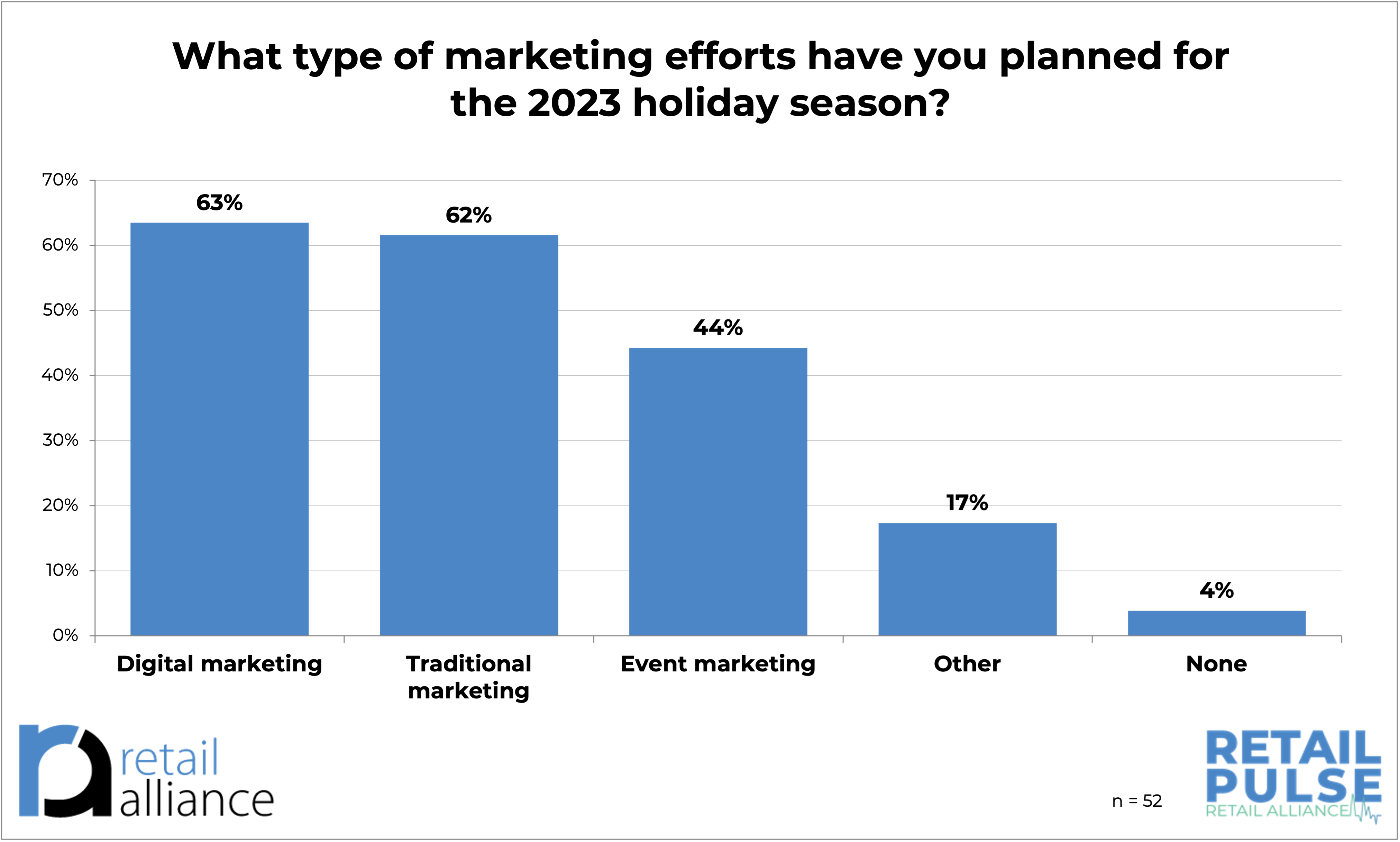

Marketing efforts spread across all channels this holiday season

The majority of retailers plan on marketing their products and services this holiday season, with both digital marketing (63%) and traditional marketing (62%) popular. Event marketing followed with 44 percent while only four percent don’t plan on doing any marketing.

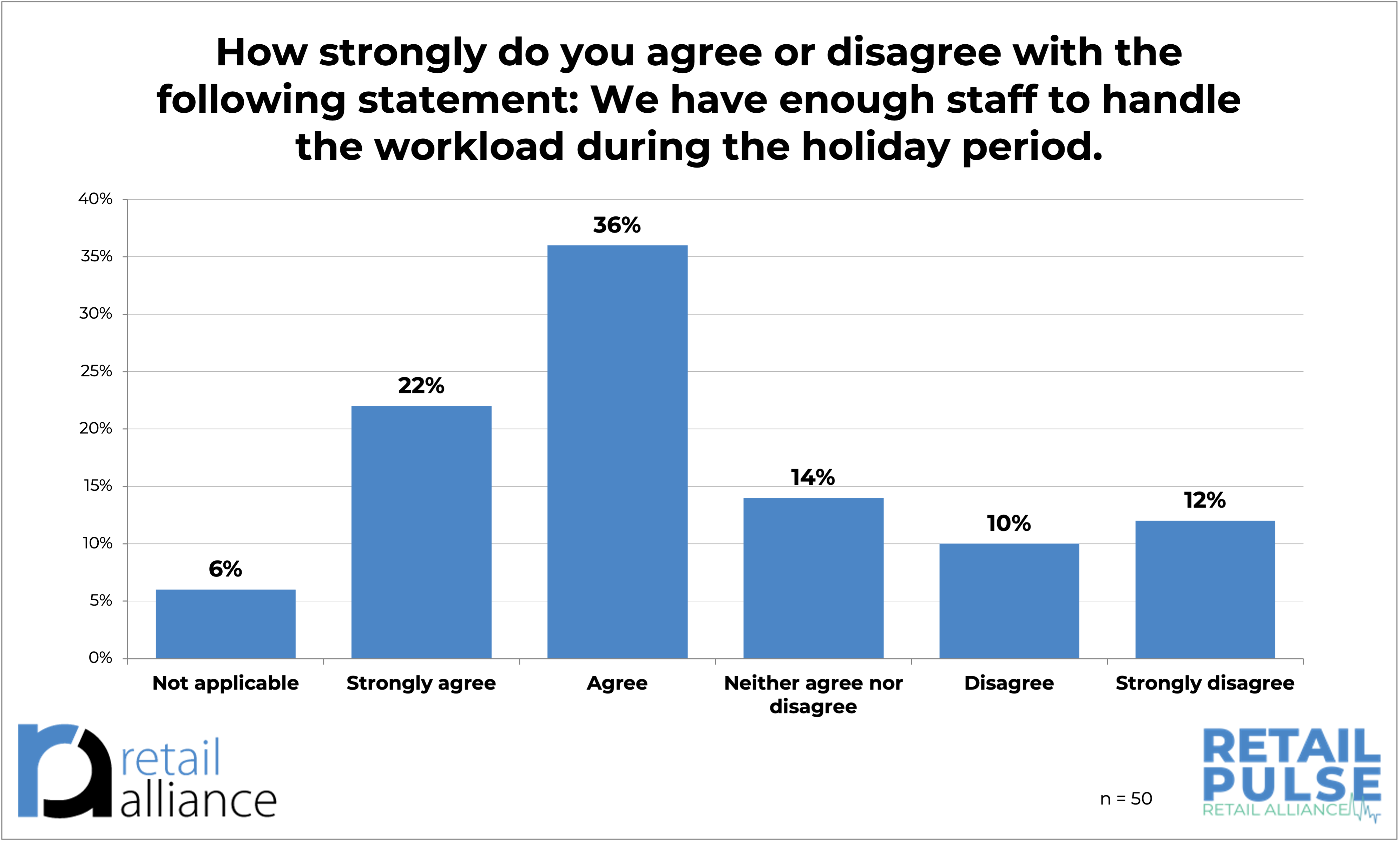

Holiday staffing under control for half of local businesses

50.8% of respondents indicated that they have enough staff to handle the holiday workload this year. That’s positive news but concerning that 21.3% feel they do not have enough staffing and another 23.0% are not sure.

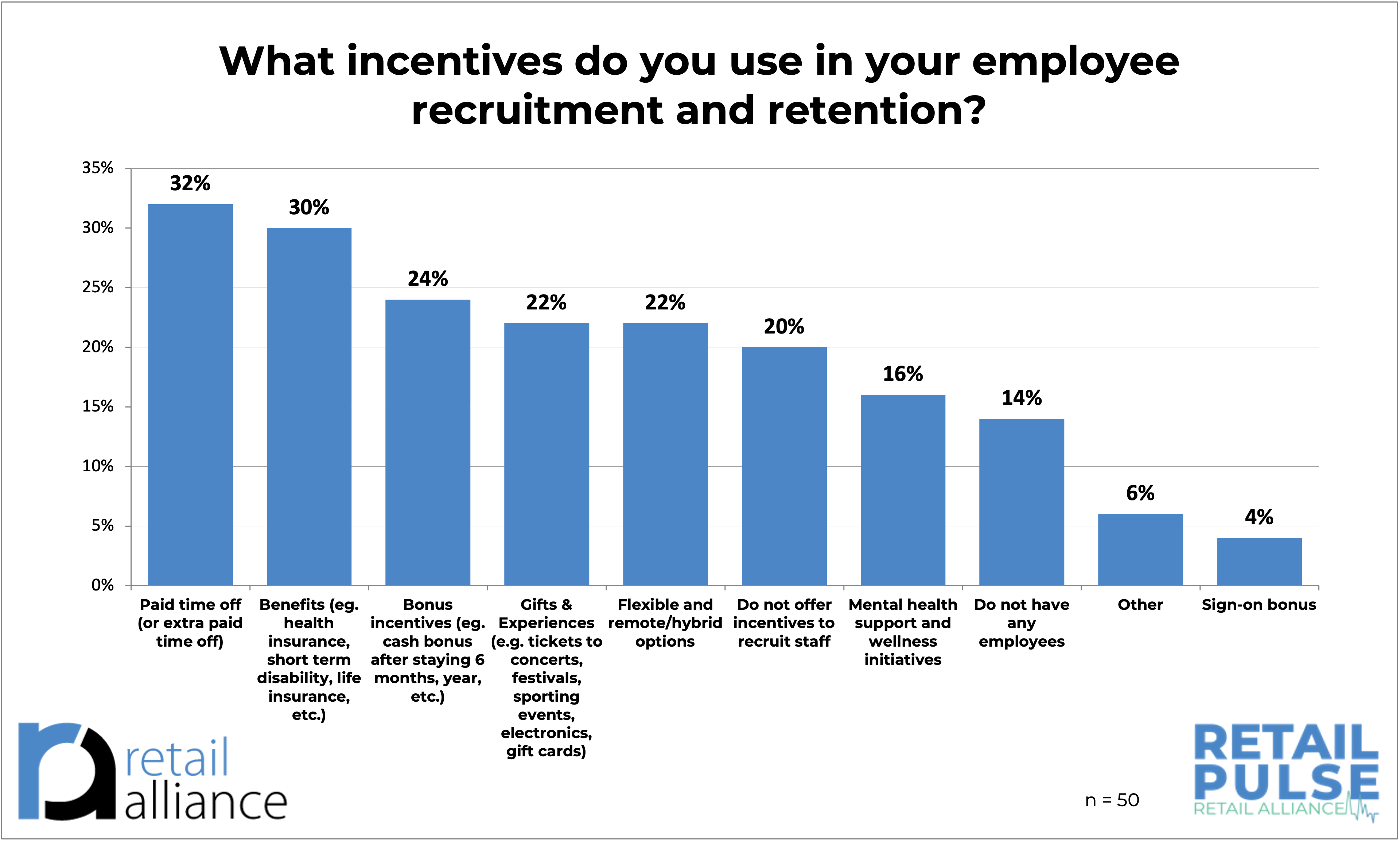

Benefits, bonuses, paid time off and flexible/remote/hybrid options used as incentives to recruit staff

Although over a third (37.7%) of the small business owners surveyed did not offer any incentives when recruiting employees, many others did. Benefits were the main incentive (23.0%), closely followed by Bonus incentives (21.3%) and Flexible and remote/hybrid options (19.7%).

About Retail Pulse Survey

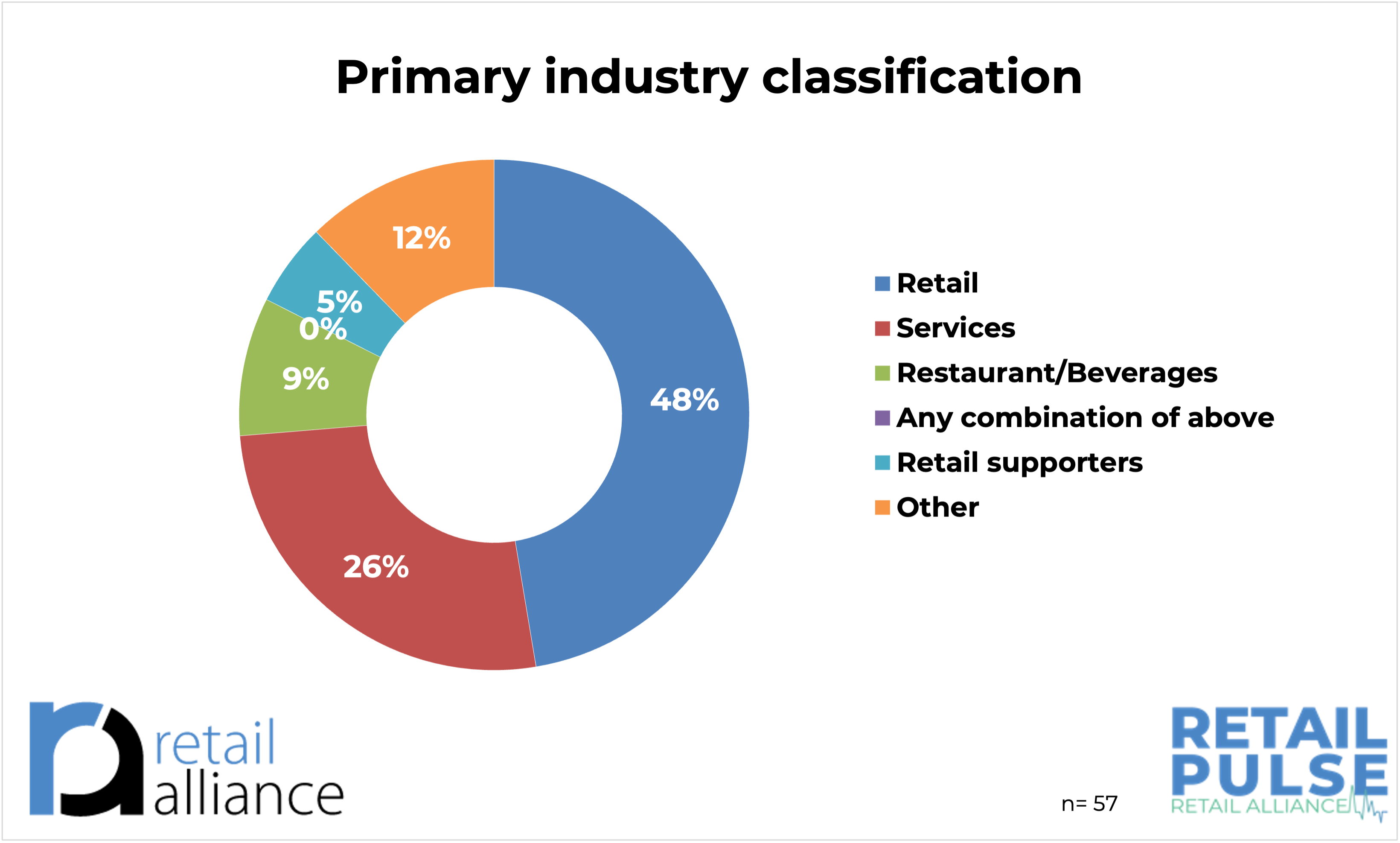

Retail Alliance’s Retail Pulse survey was conducted between November 15 and December 8, 2023. The survey received 57 responses from retailers, restaurants, services, and other small businesses, throughout Hampton Roads.

About Retail Alliance

Retail Alliance champions for the retail industry and serves as the primary non-profit retail trade association in Hampton Roads. At Retail Alliance, we unite with retailpreneurs for a thriving retail community through professional development, collaboration, innovation, a collective voice, and shared values, shaping the future of retail together. We are celebrating our 120th anniversary in 2023. www.retailalliance.com